KRYPTOIN

- Get link

- X

- Other Apps

Patent Pending Digital Currency ETF Platform

The Kryptoin ETF System is a platform that allows for the creation of a digital token representing the valuation of a combination of cryptocurrencies belonging to the same set of blockchain nodes integrated to our application. The application requires the integration of blockchains due to the inherent security risks and transactional demands of a conventional ETF ecosystem. The smart contract is utilized to bind specific requirements of an in-kind exchange between an ETF Issuer and Authorized Participant. The product of such an exchange between the parties is a decentralized system.

Kryptoin ETF Tokens will behave like a traditional ETF found on a stock exchange. The underlying assets can be exchanged/traded at a Kryptoin Trading Desk or be liquidated on a digital exchange.

GOALS

The goal of the system is to create an ETF token system that will allow users, whom we anticipate will be Global Asset Managers and Individuals, to assemble creation units or indices to fit their specific investment objectives and preferences. Most ETF tokens that will be launched would be on blockchains that are readily supported by other exchanges.

Consequently listing them on future decentralized exchanges is very likely as the protocols to list and trade them are readily accessible.

Consequently listing them on future decentralized exchanges is very likely as the protocols to list and trade them are readily accessible.

Kryptoin ETF Tokens allow individuals buyers and users of the tokens to attain risk/rewards similar to as if holding all the cryptocurrencies represented in a basket. Another benefit is that it does not need to be self-assembled and managed separately as their own portfolio. ETFs in general have proven to be a necessity and requirement in any exchange traded marketplace as evidenced by its tremendous growth.

With the world having so much data and information available and becoming more interconnected, data analysis and the research of these new asset vehicles, will increasingly be in demand. Alongside this, the public will require greater guidance and transparency. ETFs and their indices can be created to be a benchmark for many niche markets arising all over the world.

Sophisticated market players will also need derivatives and other broader exposure strategies to hedge themselves from volatility inherently found in a particular cryptocurrency. The ETF token will help newcomers and the general public to make it easier to invest in cryptocurrencies and understand the underlying technologies of each coin and further shield them from greater volatility.

The ability to connect new blockchains to the Megawallet application will enable the system to tailor ETF products and give us the following capabilities:

• The Creation of various new ETF tokens

• Effectively manage exchange rates in BTC, ETH and USD(T)

• Securely manage assets under management

• Provide a desk for service and exchange

TECHNICAL SPECIFICATIONS OF THE ECOSYSTEM

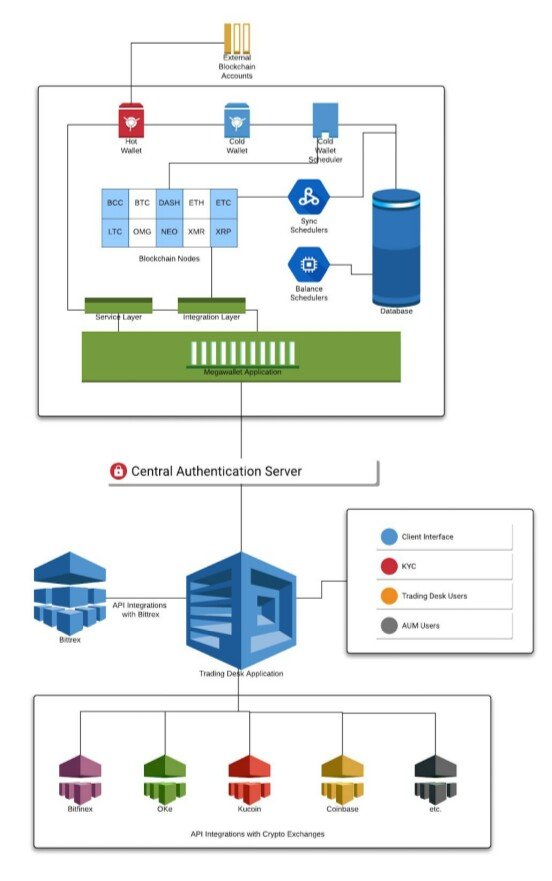

The Megawallet serves as the Kryptoin backbone for blockchain interactions. It interacts to the blockchain nodes using various intermediate layers. The system has been designed to support multiple AUMs and multiple ETF tokens.

The system is developed on high performance Node.js platform with scalable multi-tenant architecture. The system uses an integration layer to have modular interaction with the blockchain nodes. The layered architecture allows the system to add multiple new Crypto Assets at a rapid pace, hence providing future readiness. For faster user transactions the ledgers are maintained in a noSQL database. The system provides the agility to convert the business model into a future exchange for such tokenized funds.

The system also uses various schedulers which interact with Blockchain nodes to read the ledgers and sync it with our database, which are then used for user asset exchanges.

For security, we use the latest modern security architecture incorporating a Central Authentication Server (CAS); Hot/Cold Wallet strategy to fortify crypto assets against hackers; and a SSL layer for inter-component communication.

Component Level

API Layer

The API layer provides access to other components to interact with blockchain nodes in a secure and scalable manner. It abstracts all the blockchain level complexity for external applications and manages them all at its end.

Integration Layer

Integration Layer provides a reusable architecture to interact with blockchain nodes. It has all the various functions which are used by the API layer to interact with various types of crypto assets.

Service Layer

Service Layer is used for long and complex cryptocurrency related operations which require multiple node interactions in order to execute a single task. It has a reusable structure which can be used by various layers to perform complicated procedures related to third party applications.

Central Authentication Server (CAS)

Central Authentication Server provides a single point authentication service for all the constituent applications of the system. It uses OpenID Connect which is a simple identity layer on top of the OAuth 2.0 protocol, which allows computing clients to verify the identity of an end-user executed by an authorization server. The CAS also is able to obtain basic profile information about the end-user in an interoperable and REST-like manner.

Scheduler Level

Sync Schedulers

Sync Schedulers are used to constantly poll the blockchain nodes of any blockchain transactions occurring on a user’s blockchain address. It identifies the transactions and pushes them to the database.

Balance Schedulers

Balance Schedulers are used to calculate aggregated user balances after compiling all the non-database transactions that are happening on user accounts and update it to the database.

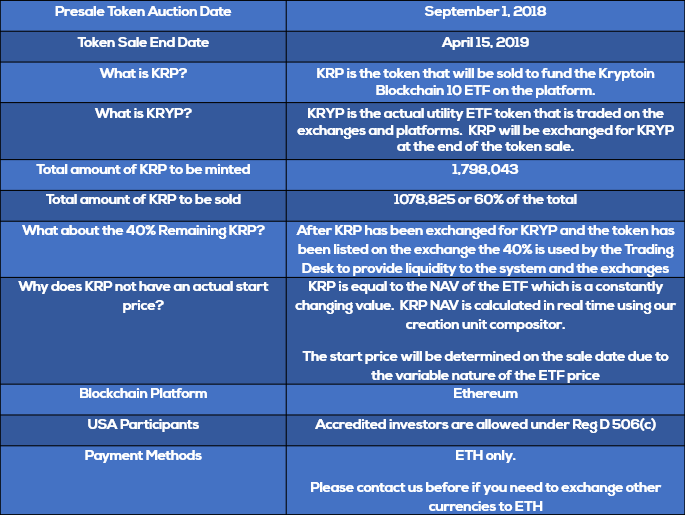

THE TOKEN SALE PROCESS

Kryptoin will hold a Initial Token Offering in the form of a Dutch Auction. This token sale event will issue Ethereum ERC20-compliant tokens to registered participants according to the ‘Kryptoin Distribution Document’. The sale process will be executed by the Smart Contract.

The details of the smart contract can be found in GitHUB and the smart contract audit has been performed by security auditor Coin Mercenary.

The details of the smart contract can be found in GitHUB and the smart contract audit has been performed by security auditor Coin Mercenary.

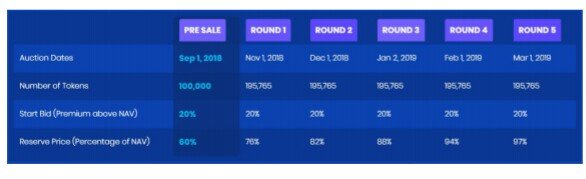

KRP Token Sale Schedule by Dutch Auction

Total Fixed amount of KRP = 1,798,043

Total Fixed amount of KRP = 1,798,043

Total amount of KRP to be auctioned = 1,078,825

Total KRP to be distributed through all 6 rounds will be 1,078,826.24 or 60% of the total

Funding goal is 114,311 ETH.

Token Sale Structure

.png)

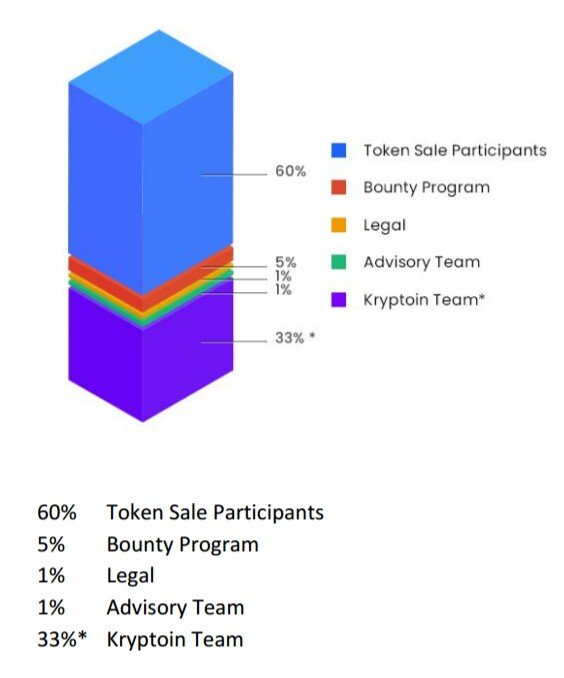

Distribution of Tokens

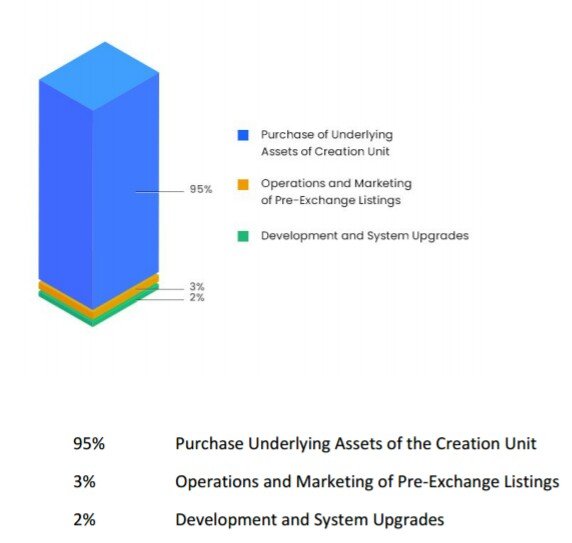

Use of Proceeds

ROADMAP

.png)

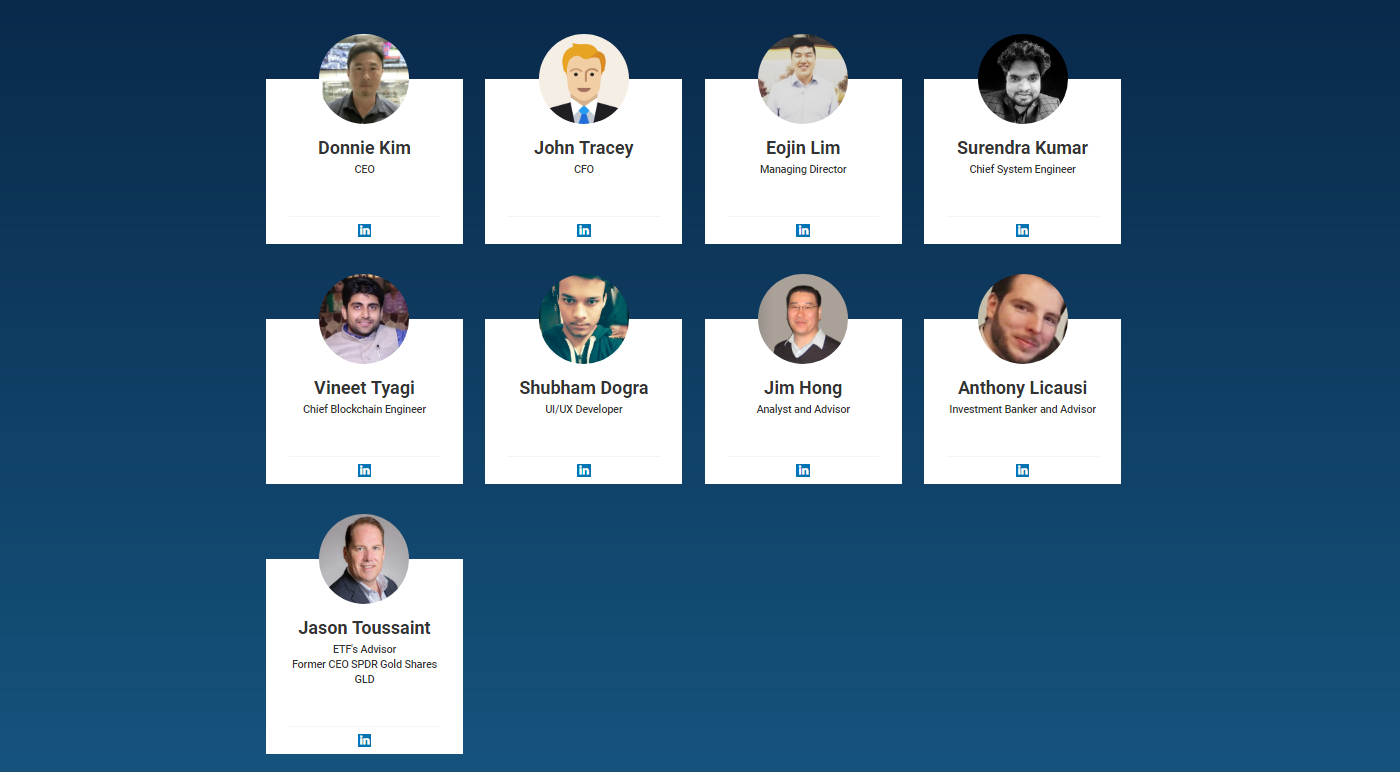

TEAM

.png)

For more information, please visit:

Website: https://kryptoin.io/

Whitepaper: https://kryptoin.io/whitepaper

Telegram: https://t.me/kryptoinETFs

Facebook: https://www.facebook.com/kryptoin

Twitter: https://twitter.com/@kryptoinETF

Author: Crator Touch

My Bitcointalk Profile: https://bitcointalk.org/index.php?action=profile;u=1612381

My Ethereum Address: 0x4883E31Bb22ec89Dd8ddbf24C7F57C1317C58F7d

- Get link

- X

- Other Apps

Comments

Post a Comment